The tax cuts and jobs act approved by congress in december 2017 under section 179 allows building owners to deduct the full costs of a roof replacement up to 1 million in the year it s completed.

Roof replacement on business building depreciation.

Because the average life of a commercial roof is just under 20 years the 39 year depreciation schedule for commercial roofs makes little business or environmental sense.

800 638 6869 mon sat.

179d tax deduction allows commercial property ownersto deduct the full cost of a roof replacement in the year it s completed vs.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

The new tax law shortens the commercial roof depreciation schedule from 39 years to 25 years that s an enormous difference.

Therefore the furnace replacement is a capital improvement to your residential rental property.

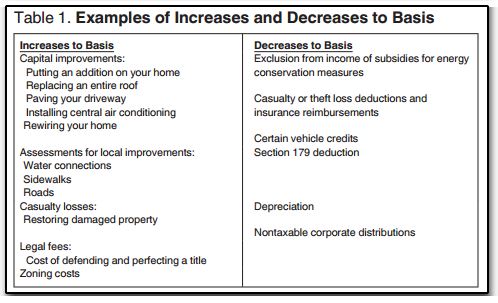

Prior to these irs repair rules that went into effect in 2014 if you replaced a building component such as an old roof with a new roof you would depreciate the cost of the new roof.

If you are ready to replace your roof contact the professionals of reliable roofing.

However changes in the tax law allowing owners to expense a new commercial roof in a single year might make installing a new commercial roof less of a financial burden for businesses.

These improvements include roofing repairs waterproofing and even full reroof projects on existing buildings.

Permitting the depreciation of roofs on a shorter more realistic schedule would encourage building owners to incur the added expense of replacing older less efficient roofs.

Your roof s depreciable life has been shortened by about 36.

This proves to be an excellent opportunity to take advantage of the all time high section 179 tax deduction to solve problems with your roof that have been plaguing your facility.

7 30 am 5 30 pm ccc024413.

Replacement of the furnace in your residential rental property.

But you also had to go on depreciating the building components you replaced along with the rest of the original structure.

Replacing the roof of your commercial building is an important expense for your business and thanks to the new amendments to section 179 the cost of a new roof does not have to cripple the expansion of your business.

Depreciating over 39 years.

Is generally a restoration to your building property because it s for the replacement of a major component or substantial structural part of the building s hvac system.

The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.