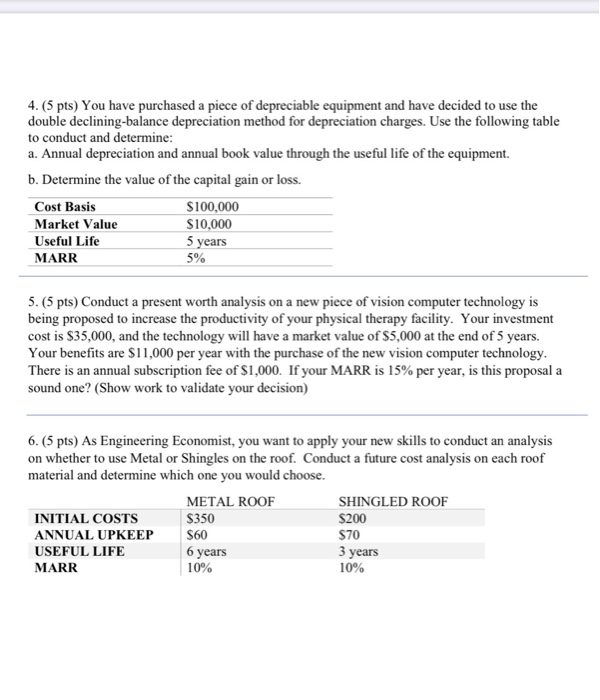

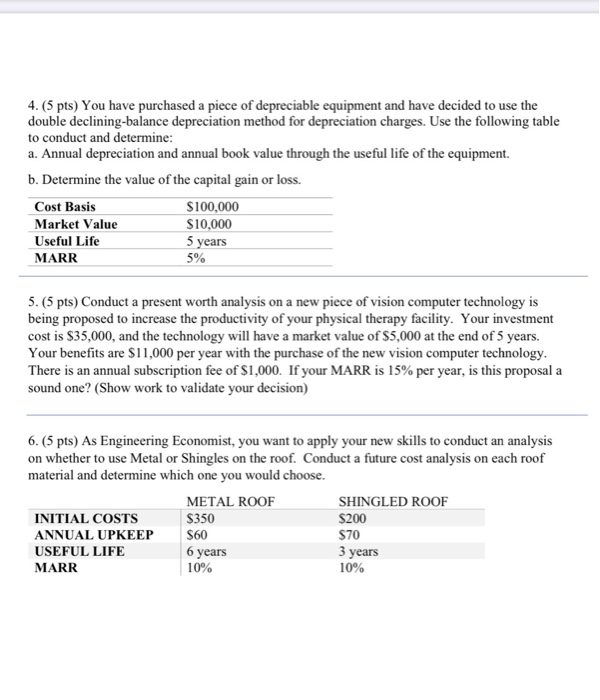

Calculating depreciation begins with two factors.

Roof shingles depreciation.

If the property is tenanted you bring the roof into service on the day you install it.

The insurance adjuster depreciated the roof 50 an arbitrary number based on its age so the actual cash value of the roof is now 5 000.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance.

This means you will get a percentage of the replacement cost based on the roof s material and age.

Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

Depreciation ends after 27 5 years when you have fully recovered the cost of the new roof.

Repair coverage usually takes into consideration depreciation of the roof.

If the property is unoccupied you bring the roof into service when you next lease the rental property.

The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.

In many cases only a portion of the roofing system is replaced and depending on the facts those costs may be deducted as repairs.

This loss in value known as depreciation can significantly affect the amount that a policyholder is paid for a claim.

If the cost is still 10 000 to replace the roof as in the above example the total amount paid for the claim will be 3 000 10 000 less 50 depreciation less 1 deductible.

The recoverable depreciation also happens to be 5 000 10 000 replacement value less 5 000 actual cash value.

Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

The replacement cost of the roof and the expected lifetime of the roof for example the average cost to replace a roof is 10 000 and asphalt roofs generally have a lifespan of 15 years.

Each year tax professionals who deal with real estate must evaluate the most recent building expenditures and determine which items should be written off as a repair expense or capitalized.

It could be as low as 15 for a roof near the end of its service life.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

For instance a 10 year old roof covered in 20 year shingles will be depreciated by at least 50 if it s in excellent shape.

Read your policy carefully.